Industry standard data security ensures client data is not compromised. Free up your internal team to deliver greater value to your clients. Outsource your tax submission requirements to us and improve service levels to boost client satisfaction. Taxfyle’s domestic outsourcing service augments your firm and creates real-time, quantitative, actionable insights for each return by how to create a powerful brand identity combining structured data collection and event streams. Providers prepare Form 1065, managing the tax reporting requirements for partnerships and ensuring proper allocation of income, deductions, and credits among partners. Consider not just the immediate expenses, but also the long-term benefits, such as reduced risk of errors and the value of having more time to focus on your core business activities.

- Customizable service options ensure that businesses receive tailored solutions that meet their unique needs, making outsourcing a strategic choice for effective tax management.

- Contact our team to find out which of these solutions is right for you or learn more about 1040SCANverify.

- While nerve wracking at first because it is the unknown, outsourcing tax services overseas can provide your accounting firm with wonderful opportunities with the right relationship.

- After brainstorming with our tax team, I chose the option that best matched our expectations – the package.

- Professional tax preparers use rigorous error-checking processes, which enhances accuracy and minimizes costly mistakes.

- Removing the barriers and overcoming the objections that prevent many firms from outsourcing.

Business development

Remember to maintain regular communication and monitor performance to address any issues promptly. Providers handle the preparation of Form 1040 and related schedules, ensuring that your personal tax return is accurately completed and compliant with IRS requirements. Regularly evaluate the provider’s performance to ensure they clarence heller are meeting your expectations and delivering quality work. Address any issues promptly and make necessary adjustments to improve the outsourcing relationship. Regular monitoring will help maintain high standards and address any problems before they escalate. Once you have a list of potential providers, outline your requirements and request detailed proposals.

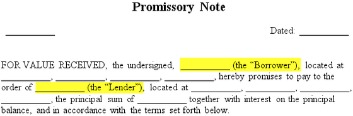

As a result, you’ll conventional cash flow overview formula example need a 7216 consent form signature from your clients before outsourcing their returns offshore. We provide multiple solutions to maximize your ability to find relief during tax season. Whether you need a straightforward approach or want to work with the Pros more closely, your sales representative can help you find the right fit. Implement our API within your platform to provide your clients with accounting services.

Sales Tax Return Services

Assess the complexity of your tax situation by examining your sources of income, available deductions, and potential credits. If your tax scenario involves multiple income streams, intricate deductions, or unique credits, you’ll need a provider skilled in handling such complexities. With outsourcing, you get a tailored approach that fits your needs. You can choose from various pricing and engagement models, ensuring that the service you receive is aligned with your specific requirements. Indirect taxes have become a leading reading revenue stream for governments worldwide.

Advisory services can help finalize business returns

This technology boosts both accuracy and efficiency, providing a more streamlined tax preparation process. Tax preparation outsourcing with Picnic Tax Enterprise helps you grow your business while enhancing your reputation and brand. We’re the outsourced solution accounting firms, wealth managers, and fintechs trust. While nerve wracking at first because it is the unknown, outsourcing tax services overseas can provide your accounting firm with wonderful opportunities with the right relationship. Talk with someone you know who is outsourcing to minimize stereotypes and fears.

Unison Globus offers offshore tax preparation services, leveraging a global team of tax professionals to provide cost-effective and efficient tax preparation solutions. Our outsourced tax preparation services can help your firm prepare more returns without adding staff. Whether your firm wants to grow its practice or simply combat workload compression, our full-time staff of trained professionals provides year-round assistance. Outsourcing tax preparation offers numerous benefits, including cost-efficiency, time savings, specialized expertise, improved accuracy, and access to advanced technology. By carefully selecting a provider and following best practices for successful outsourcing, you can streamline your tax processes and focus on core business activities.

Establishing effective communication practices will ensure smooth collaboration and prompt resolution of any issues. One significant difference between offshore and onshore outsourcing is consent. Section 7216 mandates that taxpayers give consent before their 1040 tax information is disclosed to a third party outside of the United States. In 2014, new Section 7216 language went into effect that required more explicit disclosure.

Corporate & business organization

Rarely, the 7216 form may prompt a client to request additional clarification about your data security practices. A reputable income tax outsourcing service will have clear and transparent documentation about their security protocols. Some firms keep an onshore option on deck for an additional fee in the unlikely event that a client remains resistant.

Contact our team to find out which of these solutions is right for you or learn more about 1040SCANverify. Outsourcing gives you access to tax professionals with specialized knowledge. These experts are well-versed in complex tax laws and regulations, ensuring that your tax filings are accurate and up-to-date. SurePrep has provided onshore and offshore income tax outsourcing since 2002. Firms that provide additional services like retirement and financial planning have always collected 7216 signatures. SurePrep has processed hundreds of thousands of outsourced returns since the 7216 language change in 2014, and our clients have reported little effect.